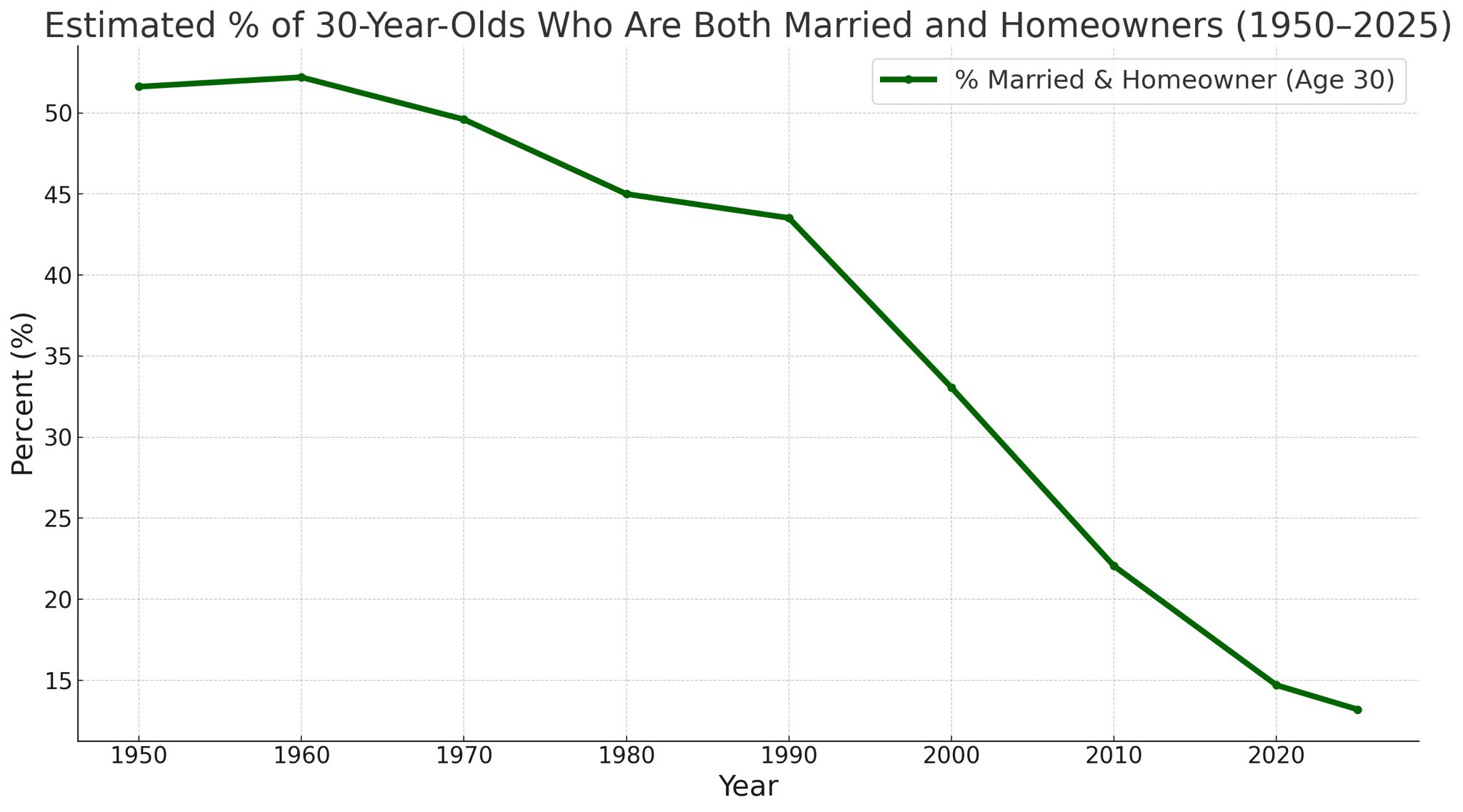

Picture a young family standing outside a charming house, dreaming of calling it home—only to watch the “For Sale” sign vanish as corporate buyers swoop in or find it locked up by an aging homeowner unwilling to move. This is the stark reality of today’s housing market, where the dream of ownership feels increasingly out of reach. The current housing crisis isn’t the result of a single factor but a “perfect storm” fueled by two powerful forces: the Baby Boomer generation’s unprecedented hold on property and the aggressive entry of corporations into the residential real estate market. A recent X post by Nathan Halberstadt (@NatHalberstadt, August 2, 2025) brought this issue into sharp focus with a striking graph showing the steep decline in 30-year-olds who are both married and homeowners, dropping from over 50% in 1950 to just 15% by 2020. Halberstadt’s post was a pointed response to Carol Wise (@CWise45411), who lamented the “22% interest fiasco in the early ’80s” as a hardship for Boomers, aiming to show that despite such challenges, Boomers had it far easier than today’s generation. Together, these trends are squeezing out new homeowners, and understanding their impact is key to addressing the crisis.

The boomers are a significant contributor to the housing supply issue, which is a major factor in the in homeownership decline.

— Hunter (@huntsyea) August 3, 2025

Existing housing supply is constrained by the increasing number of boomers choosing to age in place. Instead of moving in with family members, retiring… pic.twitter.com/wKhpYc4tdA

The Generational Divide: The “Boomer Problem”

After World War II, Baby Boomers stepped into a golden era of homeownership. Affordable prices, low interest rates, and minimal student debt made buying a home a straightforward milestone—conditions that Halberstadt’s graph implicitly contrasts with today’s struggles. This economic boom allowed many to settle in for the long haul, a trend that persists today. Data indicates that 40% of Boomers have lived in their homes for 20 years or more, with a significant portion staying 30+ years. This aging in place locks up a substantial share of the housing supply, leaving fewer options for younger generations, a point Halberstadt underscored in his reply to Carol’s nostalgia for tougher past conditions.

This prolonged tenure is compounded by the “NIMBY” (Not In My Backyard) effect, where established homeowners resist new developments to protect their neighborhoods. This resistance further tightens the supply, pushing prices higher. Meanwhile, the looming “great wealth transfer” promises to deepen the divide. As Boomers pass down property to a fortunate few, those without inheritance face an even tougher battle in an already competitive market, widening the gap between the haves and have-nots—a disparity Halberstadt’s post highlights as more severe than the interest rate woes Carol mentioned.

The Corporate Landlords: Housing as a Commodity

The corporate influence began to take shape after the 2008 financial crisis, when institutional investors and private equity firms seized the opportunity to buy single-family homes at discounted rates. Today, these corporations hold billions in what were once family homes, transforming them into rental properties on an industrial scale. This shift redefines housing from a community cornerstone to a profit-driven asset on corporate balance sheets.

The business of renting has led to higher rents, stricter policies, and a focus on revenue over community well-being. More critically, this corporate buying power removes homes from the for-sale market entirely, creating an artificial scarcity. As corporations outbid individual buyers, the inventory shrinks, driving prices to unprecedented levels and making homeownership a distant dream for many—trends that resonate with the housing struggles highlighted in Halberstadt’s X post as a rebuttal to Boomer complaints.

The Combined Effect: Squeezing the Market from Both Ends

The dual pressures of Boomer longevity and corporate acquisition are shrinking the pool of available homes. While Boomers hold onto their properties, corporations snap up what little inventory emerges, leaving first-time buyers with dwindling choices. This squeeze has profound consequences for younger generations, delaying family formation, stunting financial growth, and fostering a growing sense of hopelessness. The result is a tale of two markets: one where generational wealth and corporate power thrive, and another where the average person faces rising costs and fading opportunities—echoing the concerns raised in the X discussion sparked by Halberstadt’s graph, which framed today’s crisis as far more daunting than the 1980s interest rate spike Carol referenced.

Conclusion: What’s Next?

The housing market is under siege from both ends—prolonged Boomer ownership and corporate dominance—severely limiting access for new buyers. To turn the tide, potential solutions like zoning reform, caps on corporate homeownership, or incentives for downsizing could help restore balance. Ultimately, it’s time to rethink housing’s role in society, shifting it from a financial asset back to a fundamental human need. Only then can we hope to rebuild a market where the dream of homeownership is within reach for all, a vision that could address the generational divide so vividly illustrated by Halberstadt’s influential X post in response to Carol’s historical perspective.

Marriage data from U.S. Census Bureau "median age of first marriage" and Pew's % married at 30.

— Nathan Halberstadt 🧊 (@NatHalberstadt) August 3, 2025

Home ownership data from U.S. Census Bureau historical census housing tables.

Given layering different data, it is an estimate (as noted in figure title), but landed in reasonable… https://t.co/Yb5cu0SvSI

Sources: The data interpretations are based on the graphs provided in Nathan Halberstadt’s X post (https://x.com/NatHalberstadt/status/1951635776900415724) and the reply from Carol Wise (@CWise45411, August 1, 2025). For accurate, up-to-date information, consult reports from the U.S. Census Bureau, Redfin, the National Association of Realtors, the Joint Center for Housing Studies, the Urban Institute, and the Brookings Institution.

Leave a Reply