The “buy now, pay later” (BNPL) trend has become a dominant force in online retail, but its long-term viability remains a subject of intense debate. While financial experts raise alarms about a looming debt bubble, the conversation gains a new layer of urgency and relatability through the commentary of popular streamer Asmongold. His reaction to a detailed corporate video from BlackLine creates a compelling contrast between a clinical financial analysis and a raw, ground-level critique that resonates with a vast audience.

This is a deeper look into both perspectives, revealing how Asmongold’s commentary provides critical context to the data-driven warnings of financial experts.

Watch the video above.

The BlackLine Report: A Corporate Diagnosis

The BlackLine video is a professional, scripted analysis of the BNPL industry. It uses a single narrator and a wealth of data to present a clear case for BNPL’s inherent instability. The video outlines several key points:

- The Flawed Business Model: The report’s core argument is that BNPL companies have an unsustainable revenue model. They profit not from responsible, on-time payments, but from merchant fees and late penalties. This structure essentially profits from consumer failure.

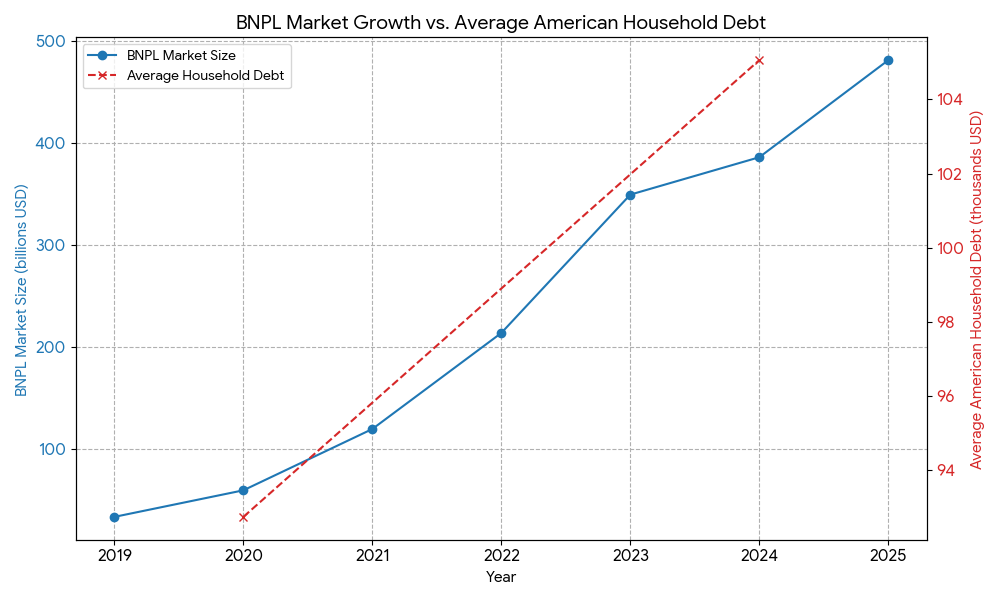

- A “Financial Time Bomb”: The video frames BNPL as a ticking time bomb, documenting the significant financial losses of major BNPL firms and the collapse of smaller players in the Australian market. This section highlights the systemic risks, not just for consumers, but for retailers and the financial sector as a whole.

- The Regulatory Vacuum: A key part of the analysis discusses how BNPL has historically existed in a regulatory gray area, free from the consumer protections and credit reporting that govern traditional credit cards.

This video is an authoritative source, laying out a logical and evidence-based case for concern. It is the foundation for the conversation, but it lacks the human perspective. This is where the Asmongold BNPL reaction becomes crucial.

Asmongold’s Commentary: A Ground-Level Perspective

Asmongold’s contribution is a critical re-examination of the BlackLine video’s points through the lens of a disillusioned public. He doesn’t just re-explain the content; he reinterprets it, turning a dry financial report into an impassioned critique of systemic failures.

- Financial Illiteracy as a Systemic Issue: While BlackLine discusses BNPL’s psychological tactics, Asmongold frames the problem as a deliberate failure of financial education. He argues that systems, from credit cards to BNPL, profit from a public that doesn’t understand compounding interest or credit mechanics. He uses personal anecdotes, such as his mother’s approach to debt, to make this point relatable and visceral.

- BNPL as an Economic Symptom: Asmongold views BNPL as more than just a flawed business model—it’s a symptom of a larger societal sickness. He connects the use of BNPL for trivial items like a burrito to broader economic pressures, arguing that people turn to these services out of exhaustion and desperation. This commentary gives a human face to the economic data.

- The “Expensive to be Poor” Paradox: One of Asmongold’s most potent observations is how the financial system is rigged. He points out the absurdity of bank fees for low balances and the moral hazard of a BNPL model that makes money when people fail. His analysis frames BNPL as a predatory service that enables a cycle of debt, particularly for those who are already struggling financially.

The Asmongold BNPL discussion serves as a powerful bridge. It takes the data and cold logic of the BlackLine report and grounds it in the realities of an audience that feels failed by the financial system. His raw, unfiltered voice resonates because it validates the frustrations of millions who feel trapped in a cycle of debt and financial illiteracy.

Two Sides of a Single Story Asmongold and BlackLine

Ultimately, both videos tell the same story about BNPL’s dangers, but they do so in different languages. BlackLine speaks the language of corporate finance, using data and logical analysis to warn of economic instability. Asmongold, by contrast, speaks the language of lived experience, using personal anecdotes and sharp social commentary to highlight the profound human costs.

Neither perspective is complete on its own. The BlackLine video provides the essential factual foundation, while Asmongold’s commentary provides the cultural and personal context. Together, they offer a complete and powerful message: the BNPL bubble is not just a theoretical risk on a spreadsheet, but a real and present danger for millions of people. For anyone looking to understand the buy now, pay later crisis, the insights from Asmongold offer an unfiltered and essential perspective.

Leave a Reply